44 coupon rate for treasury bonds

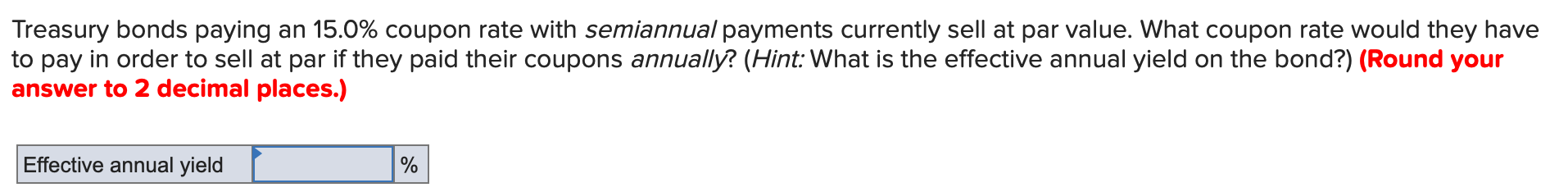

US Treasury Bonds - Fidelity Investments The coupon rate is fixed at the time of issuance and is paid every six months. Other Treasury securities, such as Treasury bills (which have maturities of one year or less) or zero-coupon bonds, do not pay a regular coupon. Instead, they are sold at a discount to their face (or par) value; investors receive the full face value at maturity. Coupon Rate - Learn How Coupon Rate Affects Bond Pricing When calculating the yield-to-maturity, you take into account the coupon rate and any increase or decrease in the price of the bond. For example, if the face value of a bond is $1,000 and its coupon rate is 2%, the interest income equals $20. Whether the economy improves, worsens, or remains the same, the interest income does not change.

Treasury Bills vs Bonds | Top 5 Differences (with Infographics) Treasury Bills Bonds; Definition: Treasury bills are debt papers issued by the government or corporate in order to raise money. T-Bills have a tenure of less than one year. Bonds are also debt instruments issued by government and corporate in order to raise debt. Tenure for corporate bonds is equal to or more than 2 years. Tenure

Coupon rate for treasury bonds

How Often Does The Treasury Bill Rate Change? - Inflation ... Currently, Treasury bill rates are hovering around 2% even for the 1 year bill. This can be contrasted with two years ago when the rates were much higher, around 4%, and also very close to current rate levels for the 2-3 and 3-4 year treasuries. In fact, on average Treasury Bill rates have a yield of around 4.5%. TMUBMUSD30Y | U.S. 30 Year Treasury Bond Overview ... Benchmark 10-year Treasury yield climbs to highest since 2018 as investors price in possible half-point rate hike by Fed in May Apr. 14, 2022 at 3:48 p.m. ET by William Watts Individual - Treasury Bonds: Rates & Terms Treasury bonds are issued in terms of 20 years and 30 years and are offered in multiples of $100. Price and Interest The price and interest rate of a bond are determined at auction. The price may be greater than, less than, or equal to the bond's par amount (or face value). (See rates in recent auctions .)

Coupon rate for treasury bonds. What Is Coupon Rate and How Do You Calculate It? Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate. In our example above, the $1,000 pays a 10% interest rate on its coupon. Investors use the phrase coupon rate for two reasons. First, a bond's interest rate can often be confused for its yield rate, which we'll get to in a moment. Treasury bonds pay coupon interest semiannually. | Chegg.com Finance questions and answers. Treasury bonds pay coupon interest semiannually. Suppose the annual coupon rate is 7%, the face value is $1,000, and the annual yield to maturity (R) is 8% with a maturity of 1 year. What is the security's duration? a.1.78 b.1.95 c.0.55 d.0.98 e.2.22. Treasury Bonds | CBK Mar 21, 2022 · Find your bond’s coupon rate, maturity date and issue date using our Treasury Bonds Results table above. You’ll find a full schedule of your bond’s interest payments in its prospectus, which you can search for in our Treasury Bonds Prospectuses table above. Kindly note that this calculator uses a coupon-based rediscounting rate. Treasury Coupon Bonds - Economy Watch The most important advantage of treasury coupon bonds is that they let you create a stable source of income during a given year. The coupon rate can vary depending upon the structure of the bonds. Some negotiable bond types come with fixed interest rates while others come with variable coupon rates based on the floating interest rate. [br]

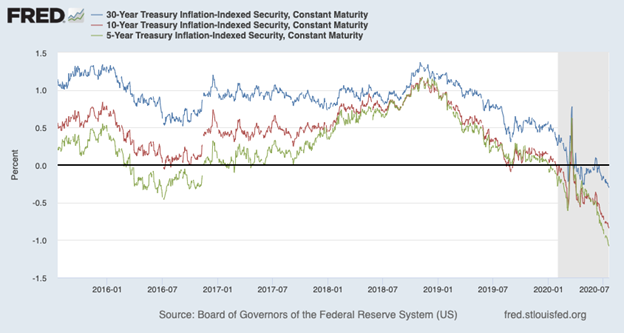

What Is the Coupon Rate of a Bond? ABC bond's coupon rate was 3%, based on a par value of $1,000 for the bond. This translates to $30 of interest paid each year. Let's say Investor 1 purchases the bond for $900 in the secondary market but still receives the same $30 in interest. This translates to a current yield of 3.33%. Individual - Series I Savings Bonds As of January 1, 2012, paper savings bonds are no longer sold at financial institutions. This action supports Treasury's goal to increase the number of electronic transactions with citizens and businesses. NEWS: The initial interest rate on new Series I savings bonds is 7.12 percent. You can buy I bonds at that rate through April 2022. Bond Yield Rate vs. Coupon Rate: What's the Difference? A bond's coupon rate is expressed as a percentage of its par value. The par value is simply the face value of the bond or the value of the bond as stated by the issuing entity. Thus, a $1,000 bond... Treasury Coupon Issues | U.S. Department of the Treasury Treasury Coupon Issues The Yield Curve for Treasury Nominal Coupon Issues (TNC yield curve) is derived from Treasury nominal notes and bonds. The Yield Curve for Treasury Real Coupon Issues (TRC yield curve) is derived from Treasury Inflation-Protected Securities (TIPS).

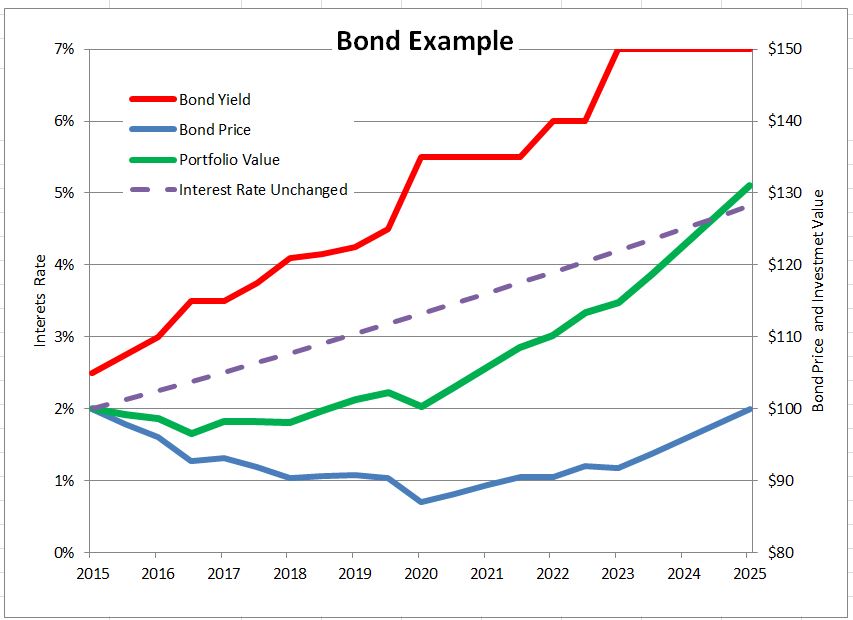

What Is a Coupon Rate? How To Calculate Them & What They ... A bond's coupon rate shows you how much interest the bond issuer pays the bondholder annually. Therefore, this rate is measured as a percentage of bond par value (face value). For instance, assume a $2,000 bond has a face value of $2,000 and a coupon rate of 2%, this means that $40 (that is 2% of $2,000) will be paid to the bondholder each ... Coupon Interest and Yield for eTBs - australiangovernmentbonds The Coupon Interest Rate on a Treasury Bond is set when the bond is first issued by the Australian Government, and remains fixed for the life of the bond. For example, a Treasury Bond with a 5% Coupon Interest Rate will pay investors $5 a year per $100 Face Value amount in instalments of $2.50 every six months. Important Differences Between Coupon and Yield to Maturity That means new Treasury bonds are being issued with yields of 4%. If an investor could choose between a 4% bond and a 2% bond, they would take the 4% bond every time. As a result, if you want to sell the bond with a 2% coupon, the basic laws of supply and demand force the price of the bond to fall to a level where it will attract buyers. Treasury Bond (T-Bond) - Overview, Mechanics, Example Treasury Bond Example Current Yield = 1 Year Coupon Payment / Bond Price = $25 / $950 = 2.63% Yield to Maturity (YTM) = 2.83% The yield to maturity (YTM) is essentially the internal rate of return (IRR) earned by an investor who holds the bond until maturity, assuming all coupon payments are made as scheduled and reinvested at the same rate.

Understanding Treasury Bond Interest Rates | Bankrate Imagine a 30-year U.S. Treasury Bond is paying around a 1.25 percent coupon rate. That means the bond will pay $12.50 per year for every $1,000 in face value (par value) that you own. The...

How does the U.S. Treasury decide what coupon rate to ... The Treasury picks the coupon to the nearest 1/8th that prices the bond closest to par. E.g. if the implied 10yr Trsy yield is 2.03% when the auction happens, the Treasury would set the coupon as 2%. Simple as that. If the coupon were set to 6%, the bond would trade at a huge premium.

US Treasury Bonds Rates - Yahoo Finance Bonds Center - Learn the basics of bond investing, get current quotes, news, commentary and more.

Bond Discount, Entries for Bonds Payable Transactions On July 1, Year 1, Livingston Corporation ...

Understanding Coupon Rate and Yield to Maturity of Bonds ... To translate this to quarterly payment, first, multiply the coupon rate net of 20% final withholding taxes by the face value (1.900% x 1,000,000). Then, divide the resulting annual amount by 4. Here's a sample of how you can compute your expected coupon income from your bond: Php 4,750.00 is the income you can expect to receive quarterly.

Coupon Definition - Investopedia Apr 02, 2020 · Coupon: The annual interest rate paid on a bond, expressed as a percentage of the face value.

Zero Coupon Bond - Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due.

investing - How can I find the price (not just the yield) of a treasury bond? - Personal Finance ...

Coupon Rate: Formula and Bond Nominal Yield Calculator Coupon Rate = Annual Coupon / Par Value of Bond. For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000. Coupon Rate = 6%. Annual Coupon = $100,000 x 6% = $6,000. Since most bonds pay interest semi-annually, the bondholder receives two separate coupon payments of $3k ...

Treasury Coupon Issues and Corporate Bond Yield Curves | U.S ... Treasury Coupon Issues Learn about the Treasury Yield Curves for Nominal and Real Coupon Issues (TNC and TRC yield curves) and The Treasury Breakeven Inflation Curve (TBI curve). Corporate Bond Yield Curve Papers and Data Learn about the corporate bond yield curve, and how it relates to the Pension Protection Act, by downloading these papers.

How Is the Interest Rate on a Treasury Bond Determined? A Treasury bond pays a "coupon rate." This is the percentage return paid to the investor periodically until its maturity date. Treasury bonds also are traded in the market. As fewer payments remain...

Coupon Rate Formula | Step by Step Calculation (with Examples) Formula to Calculate Coupon Rate. Coupon Rate Formula is used for the purpose of calculating the coupon rate of the bond and according to the formula coupon rate of the bond will be calculated by dividing the total amount of annual coupon payments with the par value of the bonds and multiplying the resultant with the 100.

Coupon Rate of a Bond (Formula, Definition) | Calculate ... The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as,

Treasury I-Bonds are Paying 7.12%! — Sapient Investments The coupon rate, which is fixed at issuance, it multiplied by the new principal amount and paid every six months. The yield-to-maturity (often simply called the "yield") calculation incorporates the principal value, the coupon rate, and the time to maturity.

United States Rates & Bonds - Bloomberg Find information on government bonds yields, muni bonds and interest rates in the USA. ... Treasury Yields. Name Coupon Price Yield 1 Month 1 Year Time (EDT) GB3:GOV . 3 Month .

Federal Reserve To Keep Buying $85 Billion In Bonds Each Month Until Job Market Improves | HuffPost

Individual - Treasury Bonds: Rates & Terms Treasury bonds are issued in terms of 20 years and 30 years and are offered in multiples of $100. Price and Interest The price and interest rate of a bond are determined at auction. The price may be greater than, less than, or equal to the bond's par amount (or face value). (See rates in recent auctions .)

TMUBMUSD30Y | U.S. 30 Year Treasury Bond Overview ... Benchmark 10-year Treasury yield climbs to highest since 2018 as investors price in possible half-point rate hike by Fed in May Apr. 14, 2022 at 3:48 p.m. ET by William Watts

How Often Does The Treasury Bill Rate Change? - Inflation ... Currently, Treasury bill rates are hovering around 2% even for the 1 year bill. This can be contrasted with two years ago when the rates were much higher, around 4%, and also very close to current rate levels for the 2-3 and 3-4 year treasuries. In fact, on average Treasury Bill rates have a yield of around 4.5%.

Post a Comment for "44 coupon rate for treasury bonds"