39 coupon interest rate definition

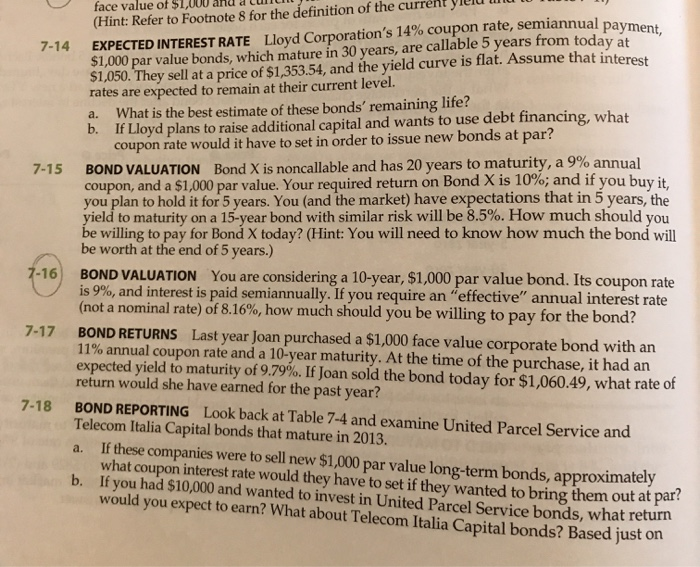

Nominal Interest Rate (Definition, Formula) | Calculation ... For example, Car loans are available at 10% of the interest rate. This face an interest rate of 10% is the nominal rate. It does not take fees or other charges in an account. Bond available at 8% is a coupon rate Coupon Rate The coupon rate is the ROI (rate of interest) paid on the bond's face value by the bond's issuers. It determines the ... Coupon Rate of a Bond (Formula, Definition) | Calculate ... Also, the issuer’s creditworthiness drives the coupon rate of a bond, i.e., a company rated “B” or below by any of the top rating agencies is likely to offer a higher coupon rate than the prevailing market interest rate to counterbalance the additional credit risk Credit Risk Credit risk is the probability of a loss owing to the borrower ...

Interest rate derivative - Wikipedia In finance, an interest rate derivative (IRD) is a derivative whose payments are determined through calculation techniques where the underlying benchmark product is an interest rate, or set of different interest rates. There are a multitude of different interest rate indices that can be used in this definition.

Coupon interest rate definition

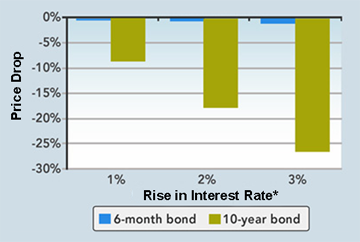

Zero-Coupon Bond - Definition, How It Works, Formula Jan 28, 2022 · To calculate the price of a zero-coupon bond, use the following formula: Where: Face value is the future value (maturity value) of the bond; r is the required rate of return or interest rate; and; n is the number of years until maturity. Note that the formula above assumes that the interest rate is compounded annually. In reality, zero-coupon ... Coupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ... Interest Rate Sensitivity Definition - Investopedia Dec 12, 2020 · Interest rate sensitivity is a measure of how much the price of a fixed-income asset will fluctuate as a result of changes in the interest rate environment. Securities that are more sensitive have ...

Coupon interest rate definition. Coupon Rate Calculator | Bond Coupon Jul 15, 2022 · However, bonds issued in a high-interest rate environment are more likely to have a higher coupon rate. Even when the interest rate goes down, the coupon rate will still stay the same. Hence, a higher coupon rate bond , in general, provides better protection for the investors . Interest Rate Sensitivity Definition - Investopedia Dec 12, 2020 · Interest rate sensitivity is a measure of how much the price of a fixed-income asset will fluctuate as a result of changes in the interest rate environment. Securities that are more sensitive have ... Coupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ... Zero-Coupon Bond - Definition, How It Works, Formula Jan 28, 2022 · To calculate the price of a zero-coupon bond, use the following formula: Where: Face value is the future value (maturity value) of the bond; r is the required rate of return or interest rate; and; n is the number of years until maturity. Note that the formula above assumes that the interest rate is compounded annually. In reality, zero-coupon ...

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

/interestrates-28359fec035e44b1a1e52b3a026d3baf.png)

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

Post a Comment for "39 coupon interest rate definition"