40 ytm zero coupon bond

Calculate the YTM of a Zero Coupon Bond - YouTube This video explains how to calculate the yield to maturity (YTM) of a zero coupon bond using the lump sum formula. Zero Coupon Bond Yield - Formula (with Calculator) - finance formulas A zero coupon bond is a bond that does not pay dividends (coupons) per period, but instead is sold at a discount from the face value. For example, an investor purchases one of these bonds at $500, which has a face value at maturity of $1,000.

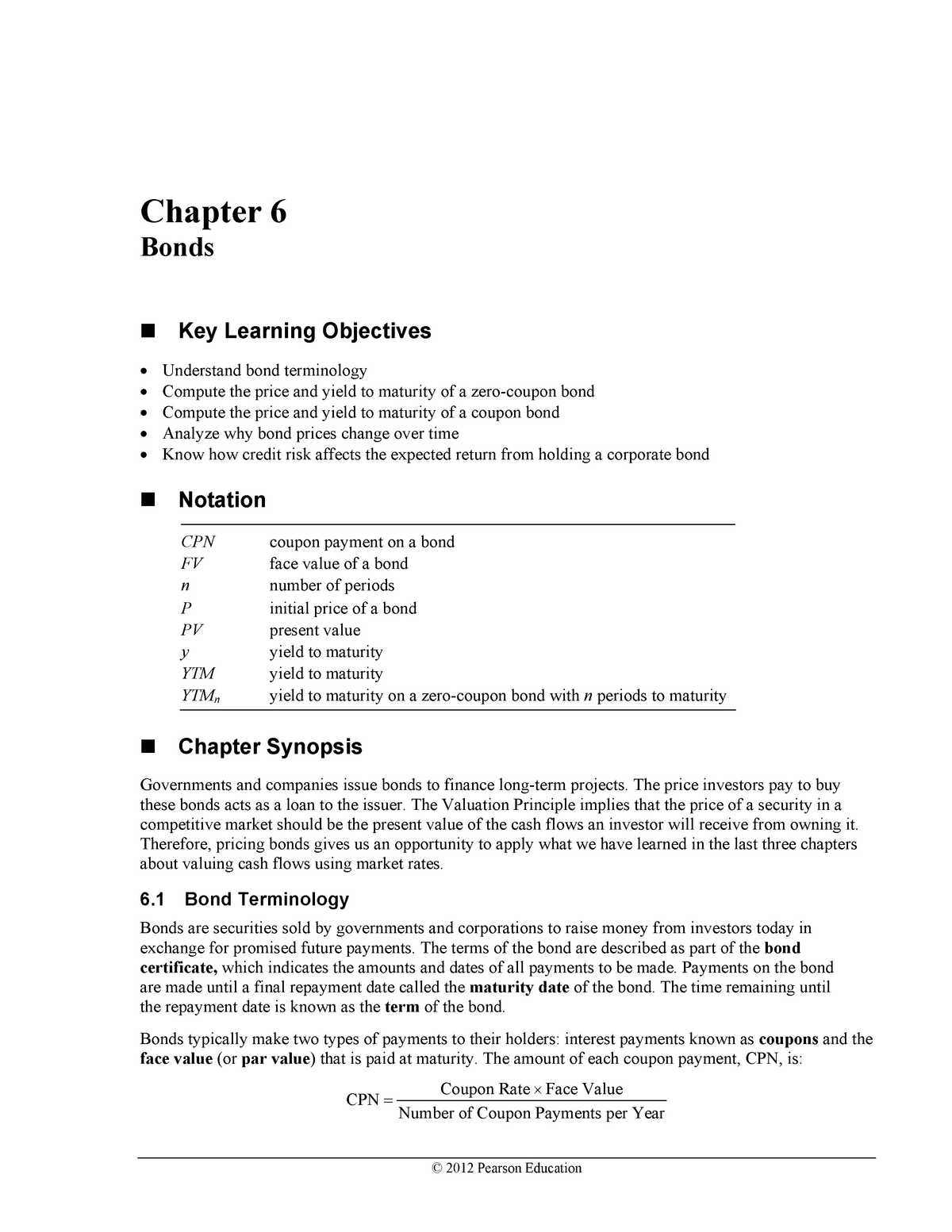

Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Calculating Yield to Maturity on a Zero-coupon Bond YTM = (M/P) 1/n - 1 variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value P = price n = years until maturity Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years.

Ytm zero coupon bond

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Cube Bank intends to subscribe to a 10-year this Bond having a face value of $1000 per bond. The Yield to Maturity is given as 8%. Accordingly, Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. How to Calculate The Yield To Maturity of A Zero Coupon Bond In this video I will explain what a zero coupon bond is and show you how to use the formula to calculate the yield to maturity of a zero coupon bond. This st... Yield to Maturity (YTM) - Investopedia The bond is currently priced at a discount of $95.92, matures in 30 months, and pays a semi-annual coupon of 5%. Therefore, the current yield of the bond is (5% coupon x $100 par value) / $95.92...

Ytm zero coupon bond. Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Zero-coupon U.S. Treasury bonds can move up significantly when the Fed cuts rates aggressively. 1 These gains can more than offset stock related losses, so Treasury zeros are often an excellent... Yield to Maturity (YTM) - Overview, Formula, and Importance On this bond, yearly coupons are $150. The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below: The approximated YTM on the bond is 18.53%. Importance of Yield to Maturity Zero Coupon Bond Calculator - What is the Market Price? - DQYDJ So a 10 year zero coupon bond paying 10% interest with a $1000 face value would cost you $385.54 today. In the opposite direction, you can compute the yield to maturity of a zero coupon bond with a regular YTM calculator. Other Financial Basics Calculators. Zero coupon bonds are yet another interesting security in the fixed income world. Zero-Coupon Bond Definition - Investopedia A zero-coupon bond is a debt security instrument that does not pay interest. Zero-coupon bonds trade at deep discounts, offering full face value (par) profits at maturity. The difference between...

Return of zero coupon bond in Excel. YTM of zero coupon bond with Excel ... Learn how to calculate yield to maturity (YTM) of a zero coupon bond with excel. @RK varsity Bond Yield to Maturity (YTM) Calculator - DQYDJ This makes calculating the yield to maturity of a zero coupon bond straight-forward: Let's take the following bond as an example: Current Price: $600. Par Value: $1000. Years to Maturity: 3. Annual Coupon Rate: 0%. Coupon Frequency: 0x a Year. Price =. (Present Value / Face Value) ^ (1/n) - 1 =. Zero-Coupon Bond: Formula and Calculator - Wall Street Prep To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Zero-Coupon Bond YTM Formula Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) - 1 Zero-Coupon Bond Risks CALCULATION OF YTM OF ZERO COUPON BOND USING EXCEL - YouTube In this lecture I am explaining how to #TYM#YieldToMaturity#HOW_TO_CALCULATE_YIELD_ON_ZERO_COUPON_BOND #YTM_IN_EXCEL calculate the yield on zero COUPON bond ...

Calculating the Yield of a Zero Coupon Bond - YouTube This video demonstrates how to calculate the yield-to-maturity of a zero-coupon bond. It also provides a formula that can be used to calculate the YTM of an... How to Calculate Yield to Maturity of a Zero-Coupon Bond Zero-Coupon Bond YTM Example Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. The formula... Zero Coupon Bond Yield Calculator - YTM of a discount bond - Vin Zero Coupon Bond Yield Calculator. A Zero Coupon Bond or a Deep Discount Bond is a bond that does not pay periodic coupon or interest. These bonds are issued at a discount to their face value and therefore the difference between the face value of the bond and its issue price represents the interest yield of the bond. Yield to Maturity (YTM) - Investopedia The bond is currently priced at a discount of $95.92, matures in 30 months, and pays a semi-annual coupon of 5%. Therefore, the current yield of the bond is (5% coupon x $100 par value) / $95.92...

How to Calculate The Yield To Maturity of A Zero Coupon Bond In this video I will explain what a zero coupon bond is and show you how to use the formula to calculate the yield to maturity of a zero coupon bond. This st...

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Cube Bank intends to subscribe to a 10-year this Bond having a face value of $1000 per bond. The Yield to Maturity is given as 8%. Accordingly, Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19.

Post a Comment for "40 ytm zero coupon bond"